With the sentiment for in the property market turning more lukewarm, developers are all on their toes to see how the market will be like in the next few months.

The number of residential units transacted in the third quarter by the National Property Information Centre shows a decline in Selangor, Kuala Lumpur, and Penang while Johor bucks the trend. (see table).

In a phone interview with StarBizWeek, IJM Land Bhd chief executive officer and managing director Datuk Soam Heng Choon says that most players are still adopting a “wait-and-see” approach to the impact due to the new cooling measures that was announced in the Budget 2014.

“We will be able to gauge what the impact is like in the next two months and make adjustments accordingly,” he says, noting that players cannot make drastic changes with what they are already doing.

Changing focus

Mah Sing Group Bhd, which entered the high-rise market the high-rise market with grade A office tower The Icon Jalan Tun Razak in 2006 followed by a number of high rise residential projects in prime areas, targets to build houses for the middle-income group going forward.

“Over the pass two years, our landbanking strategy has been more focused on locking in larger tracks of township lands for the affordable range of mid-end products,” says group managing director and chief executive officer Tan Sri Leong Hoy Kum in an e-mail reply.

This week, Mah Sing announced its foray into mainland Penang by acquiring 76.38 acres in Jawi, Penang to build landed-houses below RM500,000.

Leong says: “This is our sixth project in Penang and we want to heed the Government’s call to build properties for the middle income segment, as these products are in short supply in Penang.

“We have found a land which is rightly priced with good payment terms, and we aim to build houses that are rightly priced as well.”

He opines that the general lending environment is still conducive as interest rates are still low due to the competitive mortgage space where banks are now offering base lending rates of minus 2.4%, more attractive than minus 2.1% to 2.2% a year ago.

“As such, we believe that buyers will take advantage of this to lock in their purchases as property has always been viewed as the best hedge against inflation,” he says.

Leong also notes that land for landed residential, niche projects, high rise residential and integrated projects were acquired and developed in selected locations which had market demand for those specific products.

At the same time, the launches were planned in phases to ensure good take up, with the developer typically seeing 70% take up within 6 months of initial preview or launch, he says.

Demand for townships

For IJM Land, the company’s growth will continue to be supported by its strong pipeline of township developments such as Rimbayu, Seremban 2 and Shah Alam 2 that have been very well-received.

“Townships are our bread and butter as there will always be demand whether in good or bad times,” Soam says.

The various components of townships like retail shops, commercial components and landed property will help to diversify developers’ income sources.

“Affordability can be relative based on location,” he notes.

He says the demand for niche high-end products is determined by the pricing point and location of the project and should not be a problem if the developer gets it right.

Margins-wise, he says those for townships tend to improve as they mature whereas land cost for niche products are usually very high.

The difference between developing a township and a niche project is the developer’s stamina and knowledge, Soam notes.

Challenges

Infrastructure and planning are the important elements that make a good township and it takes a different and more sophisticated set of know-how compared with smaller niche projects.

Besides the technicalities, understanding the costing of township development is also essential in ensuring profitability.

A property player who declined to be named says that there are numerous “unseen” compliance and subsidy costs that township developers have to bear.

He says developers have to build low cost and low-medium houses, which are not profitable to comply with the requirements by authorities.

Besides that, they will also have to surrender land for amenities such as schools, power generators and sewerage treatment.

“Due to all these extra costs, developers have to alleviate some of them by passing partly to the end buyers,” he explains.

Maybank IB Research analyst Wong Wei Sum tells StarBizWeek that the demand is more for affordable housing, which is mostly found in townships.

“Usually land cost for townships is cheaper compared with small parcels, hence, make it more sustainable for such development,” she says.

She points out that luxury properties are impacted the most following the new cooling measures and expects developers to focus on affordable housing going forward.

She opines that property priced below RM500,000 per unit will continue to be in demand.

This is due to the young demographic of first home buyers in the country.

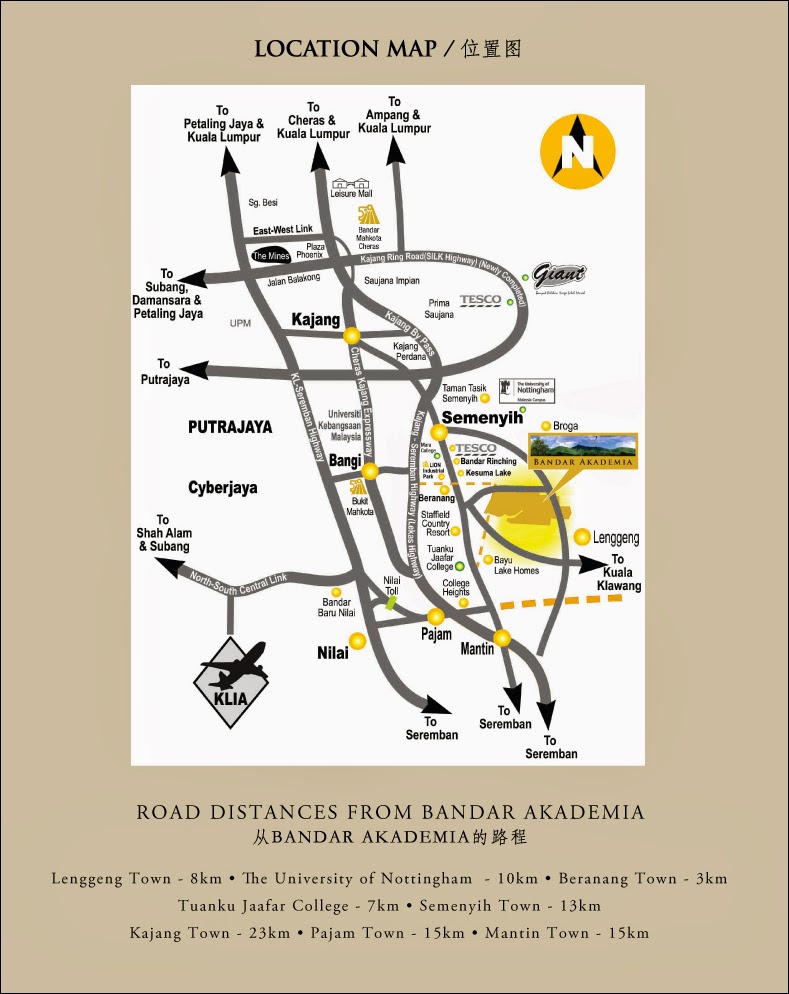

“Due to land scarcity and high prices in city centre, we expect to see new property hotspots in suburban areas such as Rawang and the southern Klang Valley such as Semenyih, Puchong South, Putrajaya and Canal City,” she says.

Some of these areas would be enhanced by the upcoming mass rapid transit lines.

This would benefit companies like IOI Properties, Glomac Bhd, IJM Land, LBS Bina Group Bhd, Gamuda Bhd and WCT Holdings Bhd, she adds.

According to her, people are willing to pay between RM600,000 to RM800,000 for landed properties while high-rise residential properties below RM500,000 are considered affordable.

Commenting on the margins for affordable houses, she says it will be lower than the high end products.

She estimates the margins for such products to be around 20% but that depends on the stage of development the township is at.

“During the initial stage, it will be less than 20% as the companies will have to allocate resources to build infrastructure,” she explains.

She notes that, however, the margins may change over time.

This is based on the product mix the players roll out as they may delay launches for certain property types until they are in demand again.

An analyst from Hong Leong Investment Bank Research concurs that developers will focus on township development backed by the strong demand for landed properties while the outlook for high-rise residential properties is challenging.

In an earlier report, CIMB Research says the residential segment will remain robust as the policy measures are meant to rein in speculation but not to restrain genuine demand.

“We believe that buying interest should progressively return in the first half of 2014 as potential house buyers come to the realisation that property prices are unlikely to fall and that potential inflationary pressures from the implementation of the goods and services tax (GST) in April 2015 could push up property prices further,” the brokerage said.

According to the property player, the implementation of GST could potentially push property prices up by about 2% to 4%.